Alsym Green: a single solution for discharge durations from 2 to 110 hours

With any solution, the more problems it solves the more value it has. The same is true for batteries. With software-configurable discharge rates from 2 to 110 hours and the ability to recharge to full capacity in under 4 hours, wide-duration Alsym Green can be used for short and long-duration needs, helping boost your return on investment. Cycle twice per day to take advantage of short-duration revenue opportunities, or select a longer discharge duration to support intra-day load shifting and multi-day outages. This flexibility is what makes Alsym Green the perfect choice for your stationary storage needs.

What is short duration energy storage?

Short-duration battery storage systems typically discharge stored energy over a period ranging from one to four hours. These systems make up more than 95% of the current market and are designed to provide quick, high-power energy delivery to meet immediate demand fluctuations, stabilize grid operations, and support various industries that require rapid energy deployment.

One of the most common use cases for short-duration storage is frequency regulation in grid applications. By quickly injecting or absorbing power, these systems help maintain grid stability by balancing supply and demand, ensuring that the grid frequency remains within safe limits.

Energy arbitrage is another key use case, where short-duration storage is used to store electricity when prices are low and sell it back during peak demand when prices are higher. This strategy helps lower energy costs for commercial and industrial users while supporting grid reliability.

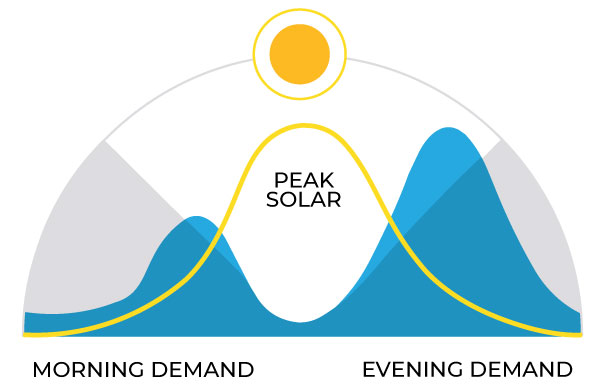

In the renewable energy sector, short-duration batteries smooth out power generation from intermittent sources like solar and wind, preventing fluctuations and ensuring a more stable energy supply. They are also deployed for peak shaving, where they help reduce energy costs for businesses by discharging stored energy during peak demand periods, minimizing the need for power generated by more expensive fossil-fuel peaker plants.

Backup power for critical infrastructure like data centers and hospitals is another essential use case. These batteries provide fast, reliable energy in case of outages, ensuring continuous operation until longer-duration systems or generators can take over.

Finally, short-duration storage systems are increasingly used in micro-grids to manage energy resources efficiently, especially in remote or off-grid locations, enhancing resilience and energy security.

What is long duration energy storage (LDES)?

Intra-day storage covers scenarios where there is a peak period in the morning but no time for batteries to recharge overnight after supporting the prior evening peak.

Multi-day storage is focused entirely on grid resilience as opposed to intraday diurnal cycles. It is designed to cover both long renewable intermittency (for example, snow covering solar panels for days, or multi-day wind lulls), and extended major system outages.

Wide, flexible duration is the answer

- Flexibility | | | |

Flexibility

Flexibility

With the ability to support software-configurable 2–110 hour discharge durations and 4-hour re-charge, Alsym Green is a single solution for use in short and long-duration storage applications. You can use Alsym Green to take advantage of rate arbitrage opportunities during hour peak demand periods, as well as support intraday load shifting needs. Alsym Green can even be used to provide continuous power for up to 5 days to address outages brought on by inclement weather or extended periods of low renewable generation, and then charge to full capacity in only 4 hours when the outage is over. That’s a considerable advantage over other dedicated LDES solutions that only address a single use case.

Covering multiple durations is valuable, but also must be done efficiently. Some multi-day solutions have round-trip efficiencies below 50%, take up to 150 hours to charge, and lose 20% (or more) of that charge over 30 days. In comparison, Alsym Green can recharge to full capacity in under 4 hours and retain more than 90% of that charge over 30 days to ensure you’re ready for the next peak demand period or extended outage–even if it’s sitting idle.

Many longer LDES scenarios are geared towards ensuring grid reliability, even in extreme cases. By definition, these scenarios aren’t regular occurrences, which means that a system designed to only address these extreme cases will not be used often. This can make it hard to build an economic business case.

The way past this hurdle is to ensure your LDES system has the flexibility satisfy several uses and to combine all of those benefits to justify the investment. This approach is called value stacking and is essential to creating the business cases for the investments the world needs now.

Low CapEx

Low CapEx

There are a number of expenditures involved with deploying a battery storage project. Batteries themselves often make up 25% or less of total project costs, with other factors making up the remainder. Referred to as Balance of Plant (BoP), these include power conversion systems (PCS), inverters, transformers, energy management systems, installation and grid integration. Additionally, civil works, site preparation, labor, permitting, and regulatory compliance contribute significantly to capital expenditures (CapEx).

Alsym Green’s low cell costs help to keep project costs low, but other factors including high energy density, low self-discharge, and high RTE contribute to Alsym Green systems having smaller physical footprints than other non-lithium systems. That translates to smaller plants, reduced cabling and power electronics, and overall lower BoP costs.

Low OpEx

Low OpEx

The biggest expenditures when operating a battery storage project include energy losses, maintenance, degradation, and the cost of charging energy. Round-trip efficiency (RTE) and self-discharge are critical factors that impact these operational costs. A higher RTE means less energy is lost during the charge-discharge cycle, which directly lowers operating expenses, especially when the storage system is used frequently. With Alsym Green’s RTE of 92% (DC), more energy is retained during storage, minimizing energy losses and reducing the amount of energy needed to charge the batteries. This high efficiency translates into lower energy costs over the project’s lifespan.

Self-discharge also plays a key role in operational costs, as energy stored in the battery naturally dissipates over time. Alsym Green has a low self-discharge rate of only 0.25% per day, meaning that the stored energy remains available for longer periods without the need for frequent recharging. This minimizes the energy required to maintain a desired state of charge, further reducing operational costs. By optimizing both RTE and self-discharge, Alsym Green helps battery storage projects maintain higher energy retention and lower energy losses, making long-term operations more cost-effective for utilities and industrial applications.

Future-proof your investment

Future-proof your investment

The electric power industry has entered a transformational period of change that’s predicted to last until 2050. During this time, the grid is expected to triple in size and incorporate dozens of new, innovative zero-carbon solutions at every stage of the value chain, from primary generation and transmission to front-of and behind-the-meter asset utilization–all while maintaining a goal of 100% reliability.

Many of these solutions haven’t even been invented, yet decisions are being made now for projects with expected 20-30 year service lives. In the face of that future dynamism and uncertainly, it stands to reason that making asset choices that can adapt to change is a much lower risk move than selecting assets that are single purpose. With Alsym Green, you have the flexibility to address the known needs of today as well as the unknown needs of tomorrow.